Ownership Structure of a Hungarian Company

In today’s global business environment, transparency in ownership structure is more than a compliance requirement, it is a key factor in establishing trust, reducing risk, and facilitating cross-border cooperation. In Hungary, the legal and regulatory framework governing corporate ownership places a strong emphasis on clarity, documentation, and accountability. This guide provides a comprehensive overview of the legal obligations, practical expectations, and best practices related to presenting the ownership structure of a Hungarian company in a transparent and credible manner.

1.1 Company Registry and Corporate Transparency

In Hungary, all companies must be registered with the Court of Registration. The Company Register (Cégjegyzék) is a public database that contains essential information such as:

- Registered seat and company form (e.g. Kft., Zrt.),

- Names and addresses of managing directors,

- Names of shareholders and their ownership stakes (in case of Kft. or other private entities).

While this registry is publicly accessible and updated, it does not always reflect indirect ownership or ultimate beneficial ownership (UBO), especially when foreign or multi-layered holding structures are involved.

1.2 Ultimate Beneficial Ownership (UBO) and TTT Registry

Hungarian legislation, in line with the EU’s 4th and 5th Anti-Money Laundering Directives, introduced the TTNY register (Tényleges Tulajdonosi Nyilvántartás) in 2021. All legal entities are required to report their UBO(s) to this central registry maintained by the tax authority (NAV).

An individual is considered a UBO if:

- They directly or indirectly hold at least 25% of the shares or voting rights in the company,

- Or otherwise exercise effective control over the company.

Failure to comply or submit accurate data can result in:

- Classification of the entity as “non-trusted” or “uncertain” ownership status (nem megbízható vagy bizonytalan),

- Financial institutions being restricted from offering services,

- Potential fines and regulatory sanctions.

2.1 Internal UBO Records

All companies operating in Hungary must maintain internal records that clearly demonstrate:

- The identity of the beneficial owner(s),

- The level and type of ownership (direct/indirect),

- The nature of control (management position, contractual arrangement, etc.),

- Nationality and tax residency (supported by official documentation),

- The full ownership chain, especially in cases involving foreign entities.

These records must be kept up to date and be available for inspection upon request by auditors, financial institutions, or tax authorities.

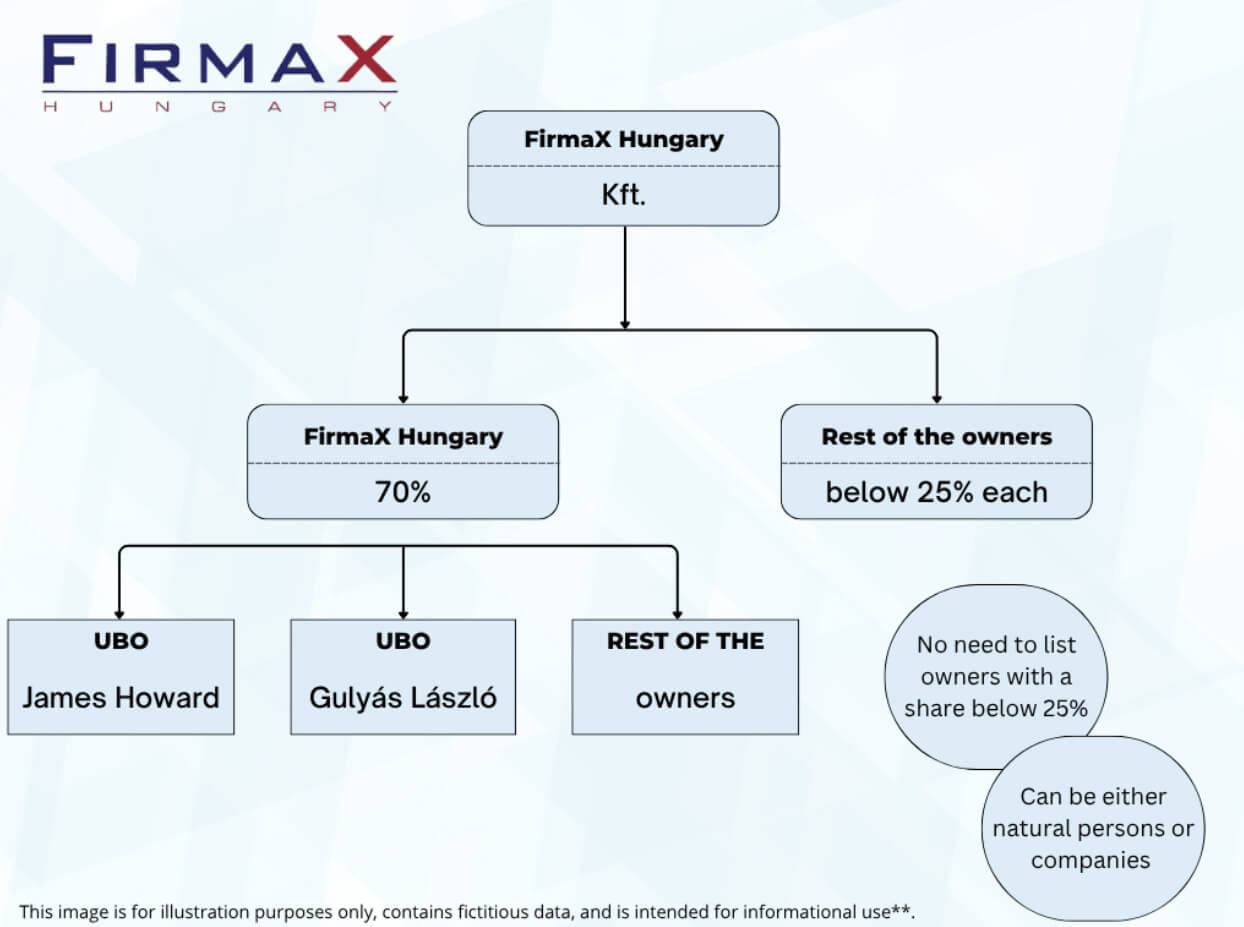

2.2 Ownership Chart

A visual representation (ownership chart) is highly recommended, especially for companies with multiple layers or foreign ownership. An effective chart should include:

- Each level of ownership up to the UBO,

- Entity names, jurisdictions, and registration numbers,

- Percentage of ownership/control,

- Clear indication of the ultimate natural persons involved.

This chart should be included in the company’s compliance documentation, AML policies, and shared with relevant partners (e.g. banks, legal advisors).

3.1 Due Diligence and Substance Requirements

If a Hungarian company is owned by a foreign entity, additional documentation is typically required to prove:

- Tax residency (Tax Residence Certificate),

- Legal existence (Certificate of Incorporation),

- Substance and activity in the country of registration (e.g., local operations, employees, premises),

- List of directors or shareholders from the foreign company’s registry.

Hungarian banks, lawyers, and accountants often demand certified translations of these documents and may reject structures lacking real economic presence (so-called “letterbox” companies).

3.2 Common Offshore Challenges

Ownership via offshore jurisdictions (e.g., BVI, Seychelles) can trigger enhanced inspection under both Hungarian AML laws and EU-wide regulations. In such cases, companies must be prepared to:

- Disclose all intermediary layers,

- Explain the rationale of the structure,

- Prove the legitimacy of the controlling individual(s),

- Comply with international tax transparency initiatives such as CRS, BEPS, and DAC6.

- Ongoing Obligations and Reporting

4.1 Regular Updates

Ownership data must be updated:

- Immediately after any structural change (e.g. share transfer, capital increase),

- Annually, as part of internal compliance reviews,

- When changes affect any entity in the ownership chain, including foreign entities.

Failing to update data may result in regulatory penalties, especially for companies working with financial institutions or participating in public procurement.

4.2 Reporting to Third Parties

Hungarian companies are often required to present ownership details to:

- Banks (for KYC and onboarding purposes),

- Tax authorities, including in the context of international exchange of information,

- Business partners, particularly in regulated sectors such as real estate, pharmaceuticals, and finance.

It is essential that the data provided be consistent across all platforms, including the Company Register, TTT, and internal documents.

Transparency is not only a legal duty—it’s a strategic advantage. Here are some recommended practices:

5.1 Keep Ownership Structures Simple Where Possible

While international investors may have legitimate reasons for multi-layer structures (e.g. tax treaties, holding management), keeping the ownership path straightforward helps avoid suspicion and simplifies compliance.

5.2 Use Local Professionals for Structuring

Hungarian legal and tax advisors can help set up structures that are both efficient and compliant. Avoid using one-size-fits-all offshore packages, which may not stand up to scrutiny.

5.3 Maintain Clear and Centralized Documentation

Ensure all compliance documentation is stored securely and centrally. A basic file should include:

- TTT printout or confirmation,

- Ownership chart,

- Tax residence certificates,

- Copies of ID/passports of UBOs,

- Translated and certified company documents of all foreign entities in the chain.

5.4 Communicate Openly with Stakeholders

Transparent communication with banks, clients, and partners increases trust and reduces onboarding times. Share ownership data proactively when needed, and explain the rationale behind the structure.

- Neglecting to update TTT after structural changes —→ Solution: Set up internal monitoring for changes and assign a responsible person.

- Using anonymous offshore companies —→ Solution: Choose jurisdictions with mutual legal assistance treaties and publish UBOs where possible.

- Over-complicating the structure without commercial justification —→ Solution: Review the structure with legal advisors annually.

- Inconsistencies between documents and statements —→ Solution: Centralize data management and perform regular reconciliations.

Strategic Benefits of Ownership Transparency

Beyond compliance, a clearly presented and well-documented ownership structure offers tangible benefits:

- Facilitates smoother bank onboarding,

- Strengthens credibility in tenders and cross-border business,

- Minimizes risk of audits and regulatory delays,

- Enhances valuation in mergers and acquisitions,

- Demonstrates ethical corporate governance and alignment with ESG principles.

Transparent presentation of your Hungarian company’s ownership structure is more than ticking a regulatory checkbox—it is a core pillar of good business. It ensures legal compliance, reduces risk, and establishes a foundation for trust in every relationship, whether with financial institutions, partners, or clients.

Hungary’s regulatory environment is increasingly harmonized with international standards, and companies that adopt robust transparency practices will find themselves better positioned for growth and sustainability. By investing in clarity today, you protect your company’s reputation and unlock new opportunities for tomorrow.